Growth Dragons Weekly: China Economy is Resilient But Stock Market Rise Depends on US Money

Here’s what happened in Growth Dragons this week:

China Economy is Resilient But Stock Market Rise Depends on US Money

NIO Strives to Maintain Pace in the Competitive EV Market

CATL, Leading in EV Battery Market, Faces 6% Decline in Market Share

WuXi Biologics Experiences Stock Sell-off Despite Gaining Market Share

#1 China Economy is Resilient But Stock Market Rise Depends on US Money

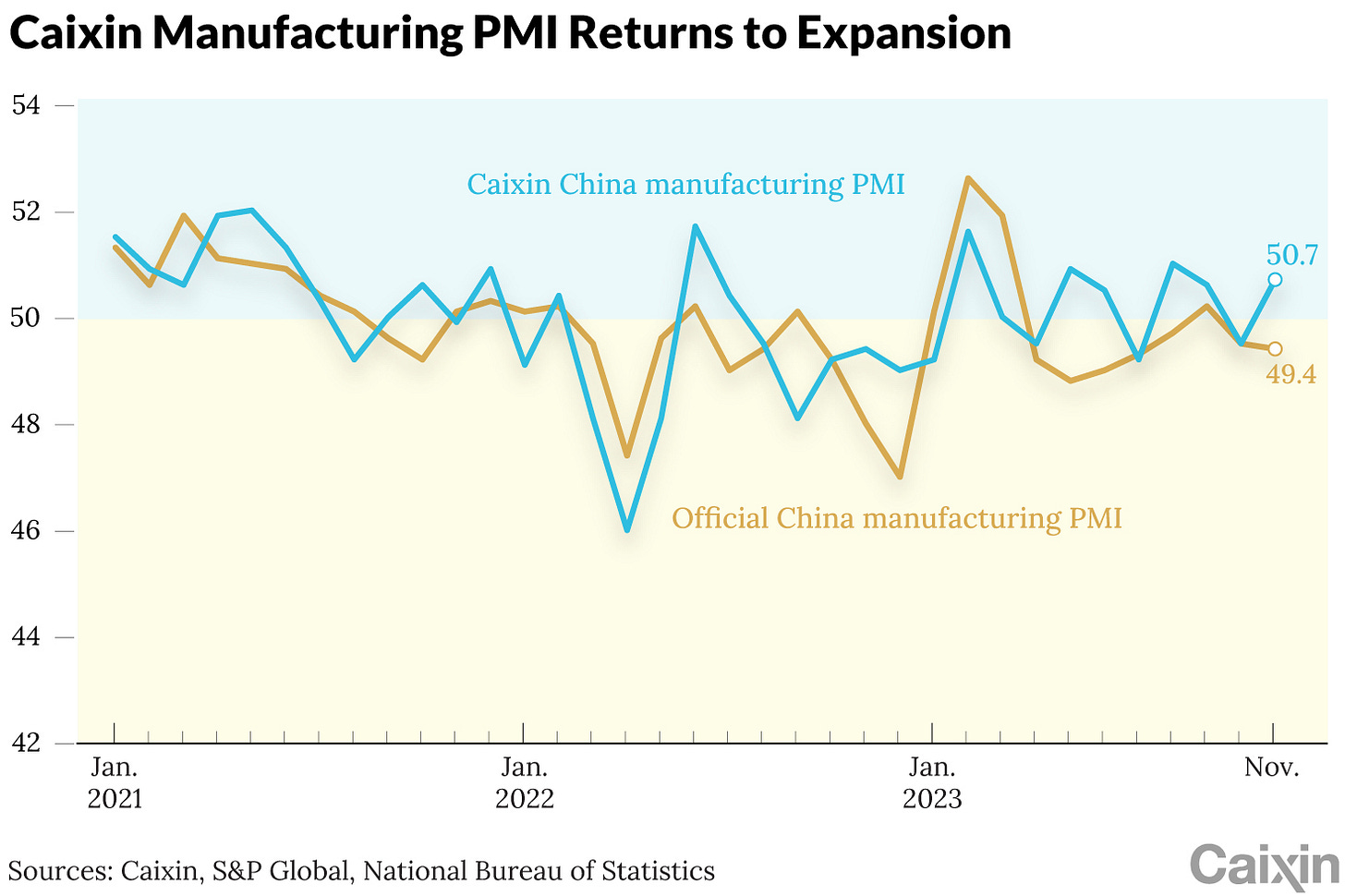

In November, China experienced mixed manufacturing Purchasing Managers' Index (PMI). The official PMI slightly declined by 0.1 points to 49.4, whereas the Caixin manufacturing PMI, which focuses on smaller, export-oriented firms, rose to 50.7 from October's 49.5.

Additionally, official data showed a modest export growth of 0.5%, a positive development for the Chinese economy as it seeks to bolster confidence.

The USD/CNY exchange rate has stabilized, with the Yuan strengthening from 7.343 to 7.1366 against the US Dollar. This trend seems more reflective of the USD's decline in value rather than intrinsic strengthening of the Yuan, especially considering the recent strengthening of the Yen against the USD.

This shift is beneficial for China, as the previously weak CNY exacerbated debt issues for property developers, who faced higher costs for USD-denominated bonds. The stronger Yuan now offers them some relief. There is some room for CNY to strengthen before it hurts export.

However, the path to recovery remains challenging. The CSI 300 Index is nearing a five-year low, and the Hang Seng Index has hit a 13-month low, casting a shadow over investor sentiment. Despite the resilience of the Chinese economy, the declining value of stocks is leading many investors to lose confidence.

We have previously discussed that the downturn in China's stock market is attributable to two factors: the negative portrayal of China in Western media and the US's influence over fund flows, which are currently exiting China. This trend does not reflect the fundamental performance of Chinese companies, many of which have reported growth.

A reversal in these trends is essential for a market recovery. Notably, $200 million worth of mainland China stocks were acquired last week, according to Stock Connect data. Prominent fund managers from UBS, Fidelity International, and Lazard are indicating a potential market bottom. Still, persistent and significant buying activity in the Chinese stock market is needed to sustain a bull market.