At the start of this year, we discussed Anta (SEHK:2020) due to its 44.5% owned associate company, Amer Sports (NYSE:AS), being listed in the US. Amer Sports' share price has performed well, achieving a 19% increase from its IPO price of $13.

We also mentioned that Anta was the second-largest sportswear brand in China by sales in 2022. Domestic brands like Anta and Li Ning have been making gains against international giants such as Nike and Adidas, driven by a surge in nationalist consumption within China.

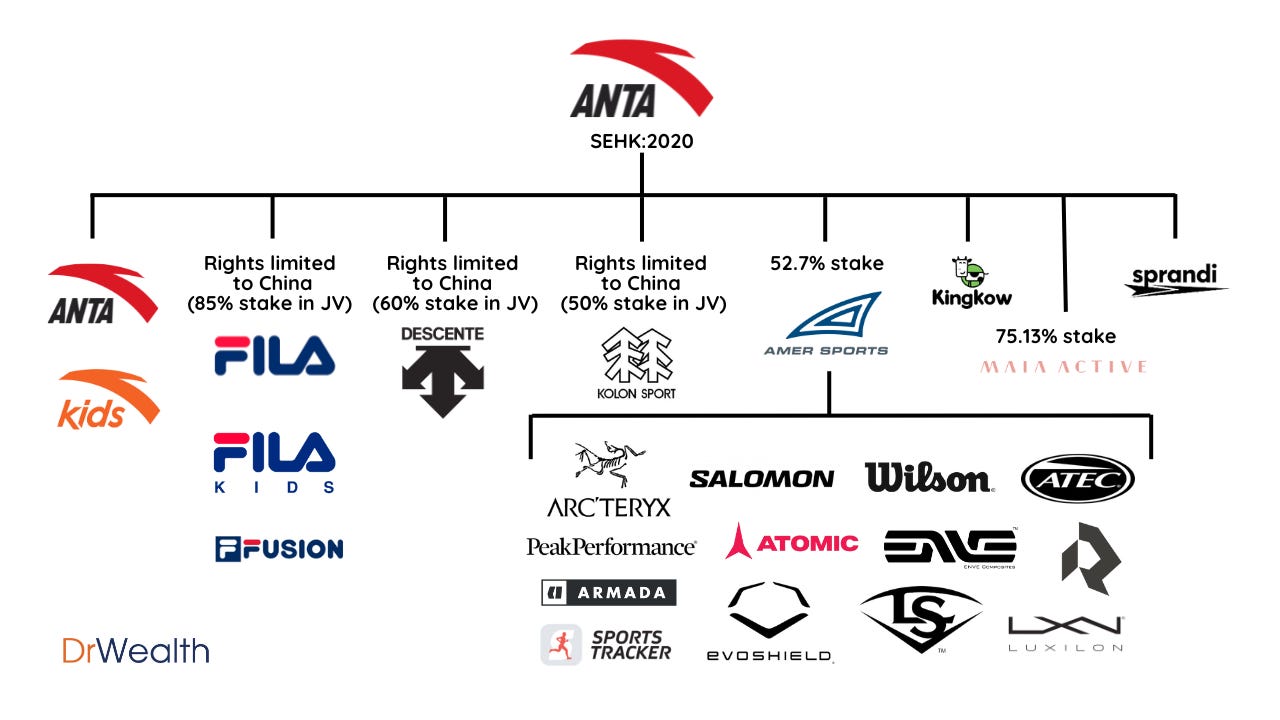

While both Anta and Li Ning are Chinese brands, their strategies diverge significantly. Anta has embraced a multi-brand strategy, whereas Li Ning has chosen to focus on a single brand. Each approach has its advantages and disadvantages.

A multi-brand strategy typically offers greater revenue and earnings stability. If one brand underperforms, others can compensate, ensuring overall company performance remains strong. This is similar to a diversified investment portfolio, where volatility is minimized and returns are not dependent on a single entity.

However, Anta's revenue relies heavily on two main brands: Anta itself, contributing 48.6%, and Fila, accounting for another 40.3%. Other brands, such as Descente and Kolon Sport, contribute only 11.1%. It's crucial to recognize that Amer Sports does not add to Anta's revenue but does contribute to its share of associate profits. Including Amer Sports, it would have added 14 billion yuan, about 20% of Anta's FY23 revenue. Hence, the multi-brand strategy is less apparent until Amer Sports' contributions are considered.

The challenge of a multi-brand strategy is the potential for cannibalization, especially without clear market segmentation for each brand.

Conversely, Li Ning, by focusing on a single brand, avoids this issue and can channel all resources into its development.

Between the two, our preference leans towards Anta, not solely for its multi-brand strategy.